Hey guys,

Back in professional mode after the weekend’s shenanigans and ready to crush the week. Coffee, a sneaky blueberry muffin, Bloomberg and my charts. Hello Tuesday!

Today isn’t about story time, today is about getting paid, so let’s get straight into the markets, shall we?

Market Overview

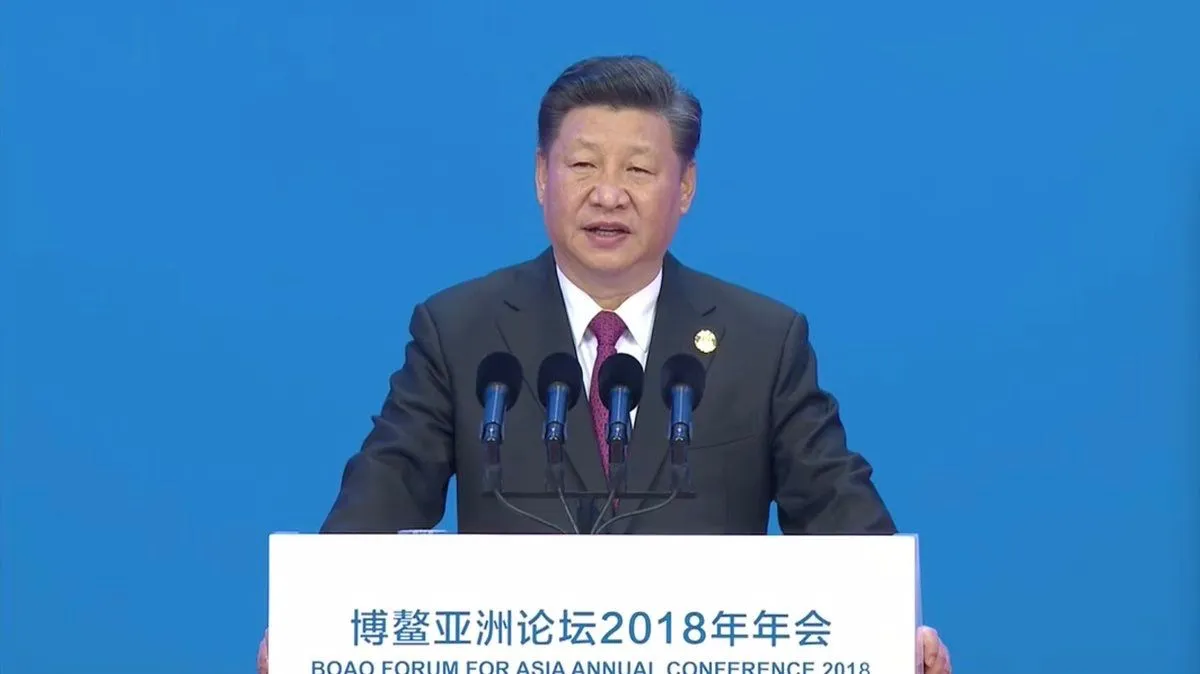

There is one thing and one thing only, on the minds of traders today and that is Chinese President Xi Jinping’s keynote address at the Boao Forum for Asia. It’s an annual conference in what they bill as a so called tropical part of China. The Chinese Hawaii, if you will.

I can’t get passed calling somewhere The Chinese Hawaii and have to learn more about this mythical place. Please, I know the Chinese community on Steemit goes off and if you know anything about the place, I’d love to hear more in the comments section!

My opinion of Chinese economics and what you see from the outside, is one of total smoke and mirrors. For this reason, I’m not putting the weight on what Xi says, but rather how far the market reacted and to which aspects.

Xi is well aware of his audience and how important today’s speech was to keep the Chinese economy open enough to continue progressing, while saving the face that an autocratic dictator, and don’t amongst all this forgot that is exactly what Xi is, must maintain.

Here’s a snapshot summary of Xi’s speech, from our friends at Bloomberg:

- Xi says China will lower import tariffs for vehicles.

- China will ease foreign equity restrictions in car industry.

- Pledges to open shipping, aviation, financial sectors for more foreign investment.

- Plans to strengthen property-rights protection, oppose monopolies.

- Says cold war, zero-sum mentalities 'out of place,' dialogue is way to resolve disputes.

The media is reporting that Xi has “vowed to open sectors from banking to auto manufacturing”.

Excuse my skepticism but, lolll okay! He’s said all the right things and on the surface, that being Trump’s Twitter, it looks like both warring sides seem content and as a result, so are markets.

Meh.

Forex and Indices Markets

Taking a closer look at the market reaction today and we have US stocks via the SPX rising steadily during Xi’s speech, while the USD also saw buyers happy to step back in.

But the overall sentiment has been risk-on as expectaions of a trade war seem overstated as not even the unpredictable might of China, wants to risk a slowdown within their own economy and have gladly taken a political, give and take approach to Trump’s policy antics. Common sense that is scarily refreshing.

I then go back to what I said above and that the important thing here for me, isn’t what Xi actually says, because it’s all smoke and mirror bullshit if it comes out of China, and that I’m nstead looking for an overblown market reaction. Is this risk-on sentiment too good to be true? Well we’ll have to see how far markets run before making a trade call based on this, but that’s my thought process on the back of things here.

Onto the charts and frustratingly, because I’m a povo freelancer these days, my TradingView account doesn’t update the SPX chart live, so you can’t see the risk rally here:

SPX Daily

Wait until the market opens during tonight’s US session and you’ll see yourself, but things are looking bullish there on the surface.

Moving back to forex markets and you can see the less significant USD buying clearly on the USD/JPY chart below that I’ve combined with my USD/JPY long trade update:

USD/JPY Hourly

Remember, we’re still building a bigger long position here after price bounced off higher time frame support. Don’t bail on your multiple entries until those intraday higher highs stop.

Have a good one! ✌🏻

@forexbrokr | Steemit Blog

Market Analyst and Forex Broker.

Twitter: @forexbrokr Instagram: @forexbrokr

Leave a comment to chat about forex and crypto trading mentorship.

Return from Chinese President Xi Speaks at the Chinese Hawaii 😂😂. Markets React to forexbrokr's Web3 Blog