Hey guys,

I’m still catching up on some sleep debt after waking up at 4.30 for the ANZAC Day dawn service and paying my respects to those that have served in the armed forces both past and present.

Mother Nature turned it on for the morning, with a beautiful sunrise over the ocean:

I’m also nursing a bit of a hangover and after delaying the post for the whole day, it’s now or never for me to smash out some content and trading analysis.

So let’s get into it, yo!

Market Overview

So getting back into the swing of things after [lANZAC Day in Australia yesterday, let’s take a look at some of today’s market highlights:

- A high US Dollar

- High oil prices

- High equities prices

- High bond yields

- ...Gold at lows

Can you spot the odd one out? We’ll go into that in more depth later on in the blog, but gold’s price suppression is definitely opening up some nice trading opportunity heading forward.

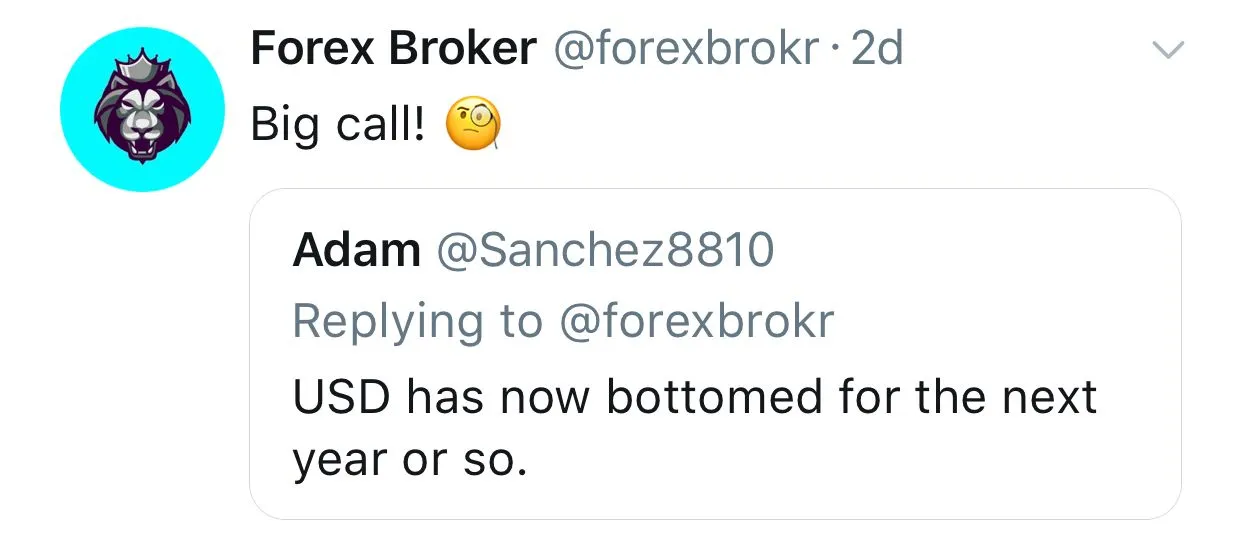

So we have the US Dollar at its highest level in 3 months. On the @forexbrokr Twitter account, a few of us have been having a conversation about USDX possibly having put in a bottom for the year. A hugely bold call, but with support holding nicely, the technicals support the theory. For now.

We also have seen higher oil prices with the WTI price increasing and now pushing the $70 a barrel level. Maybe we are on track for $100 a barrel oil after all. Jesus, that’s crazy just for me to say. The only question to ask here, is will Trump’s impending abandonment of the Iran nuclear deal see oil markets continue to rise on the back of Middle Eastern geopolitical uncertainty?

Stocks are starving off the threat of interest rates rising. Well if inflation continues to rise with oil, it might just stay a threat, but honestly who would have thought this would even be a question just 6 short months ago. Markets are nuts.

Bond yields on the other hand, continue to hold up, with the US 10 year hovering around the 3% level. Now they have pulled back for the first time in a couple of weeks, but nothing significant enough to do any structural damage to the market.

Finally, as I briefly mentioned above, Gold has decreased to its weakest level in more than 5 weeks and is going to offer us some juicy trading opportunity that I go over below.

Forex Markets

Starting with the US Dollar, you can see the Twitter convo that I mentioned having, just below:

Anyway, after ripping off that higher time frame trend line and breaking out the top of the ascending triangle...

USDX Daily

...You can now see that price has pulled back to retest the breakout level:

USDX Hourly

As far as I’m concerned, the Dollar is still as strong as an 🐂 and the boys on Twitter seem spot on. I can actually see price pulling back a little lower under that breakout zone, but it’s going to bounce.

This will continue to bode well for the Cable short trade that we have been holding and adding into from the weekend’s forex weekly market preview:

GBP/USD Hourly

It’ll be interesting to see how much the USDX pullback effects this one, but as long as price doesn’t continue to break and hold above our 2nd entry point, there’s no point bailing on this one yet. Maximise maximise MAXIMISE!

Commodities Markets

The other asset class that I have been itching to talk about from a trading perspective, is of course commodities.

Now in my other weekly market preview, you’ll remember that I spoke about the following higher time frame zones in both oil and gold:

CL Weekly

XAU/USD Weekly

I spoke about how the zones will likely act as magnets and pull price up into them now that we’re so close. I liked the oil chart a lot more than gold, but as gold goes down on the intraday charts, the more attracted to it I am:

XAU/USD Hourly

There’s certainly plenty going on in that zone there on the hourly. How to trade it is another story though. I can’t settle on how to go about it

Are you looking to buy gold at these prices? Leave me a comment and let’s chat strategy!

@forexbrokr | Steemit Blog

Market Analyst and Forex Broker.

Twitter: @forexbrokr Instagram: @forexbrokr

Leave a comment to chat about forex and crypto trading mentorship.

Return from Gold Offers Trading Opportunity as the Day’s Odd One Out to forexbrokr's Web3 Blog