Afternoon team,

Markets are open already, but after a busy weekend, I'm just getting my weekly market preview done now.

With some of the majors featured in last week's preview not testing any new higher time frame support/resisance zones, I've mixed things up a bit here with a look at Bitcoin and Gold.

Both markets that I like to watch and trade when opportunity presents.

Best of probabilities to you,

Dane.

Technical Analysis

So let's get straight into the charts, yeah?

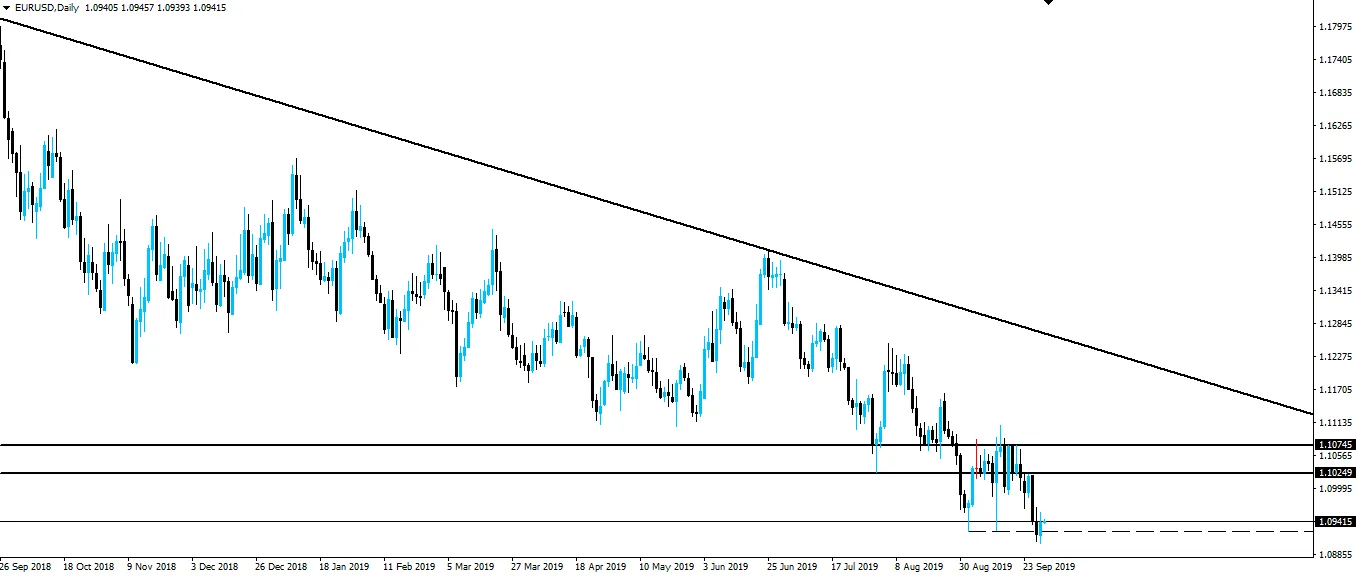

EUR/USD

- Higher time frame bearish trend.

- Below higher time frame support/resistance.

After new lows formed in EUR/USD last week, price has since stalled at the level.

I'll be watching to see if price dumps through the swing lows and then retests broken support, this time as resistance for a possible short trade.

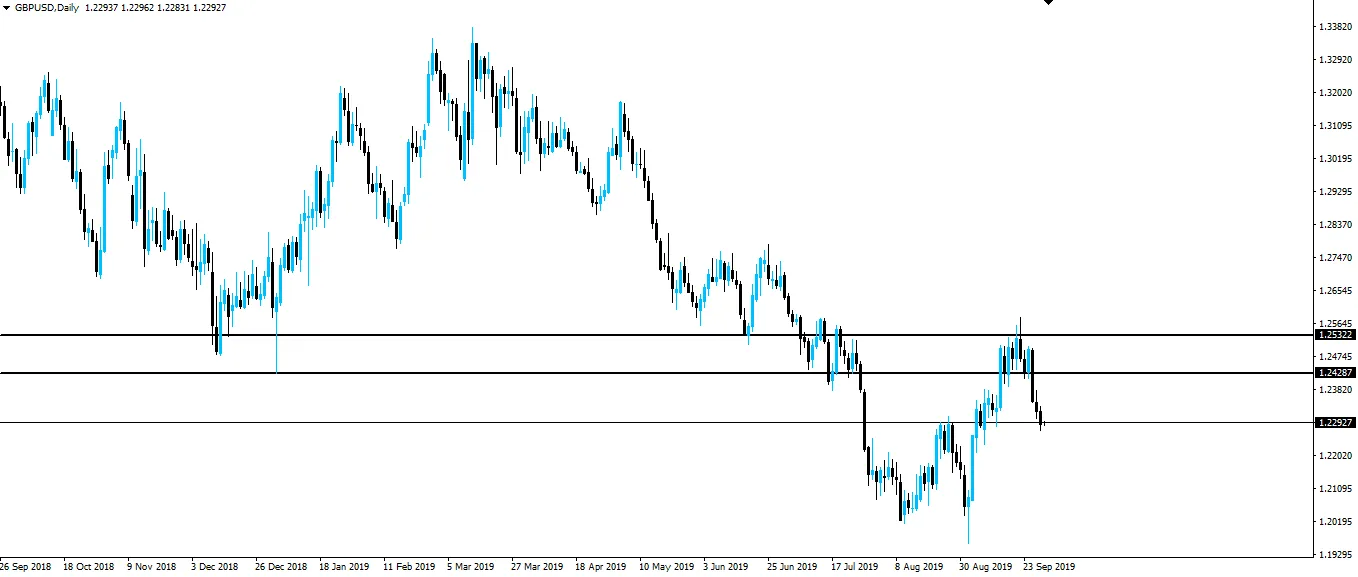

GBP/USD

- Higher time frame bearish trend.

- Below higher time frame support/resistance.

After GBP/USD turned at resistance, those inside my Inner Circle traded the drop, shorting Cable as the pair gave us a clean intraday retest to sell into.

Price has continued lower and this could well be a signal that price wants to go all the way back down to swing lows. The next level of higher time frame support/resistance.

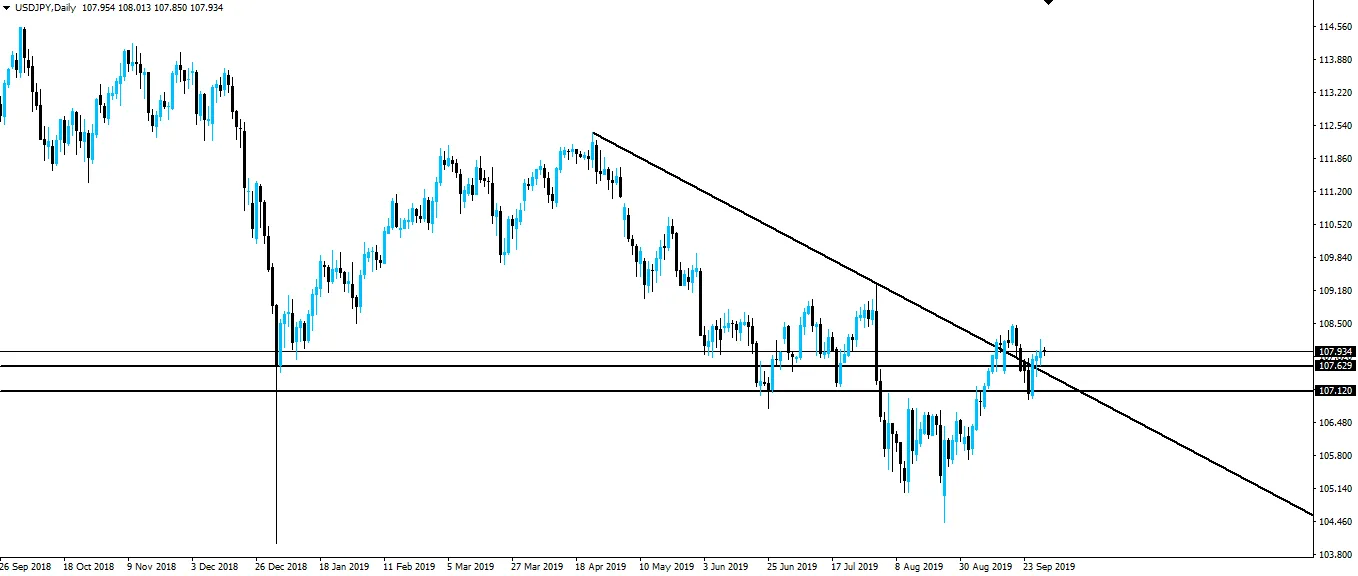

- Higher time frame bearish trend.

- Above higher time frame support/resistance.

We last week saw USD/JPY retest previous resistance as support at the confluence of both horizontal and trend line support/resistance.

With price starting to move higher, I really like the intraday price action on this pair. Something I'll be talking about trading inside my Inner Circle this week.

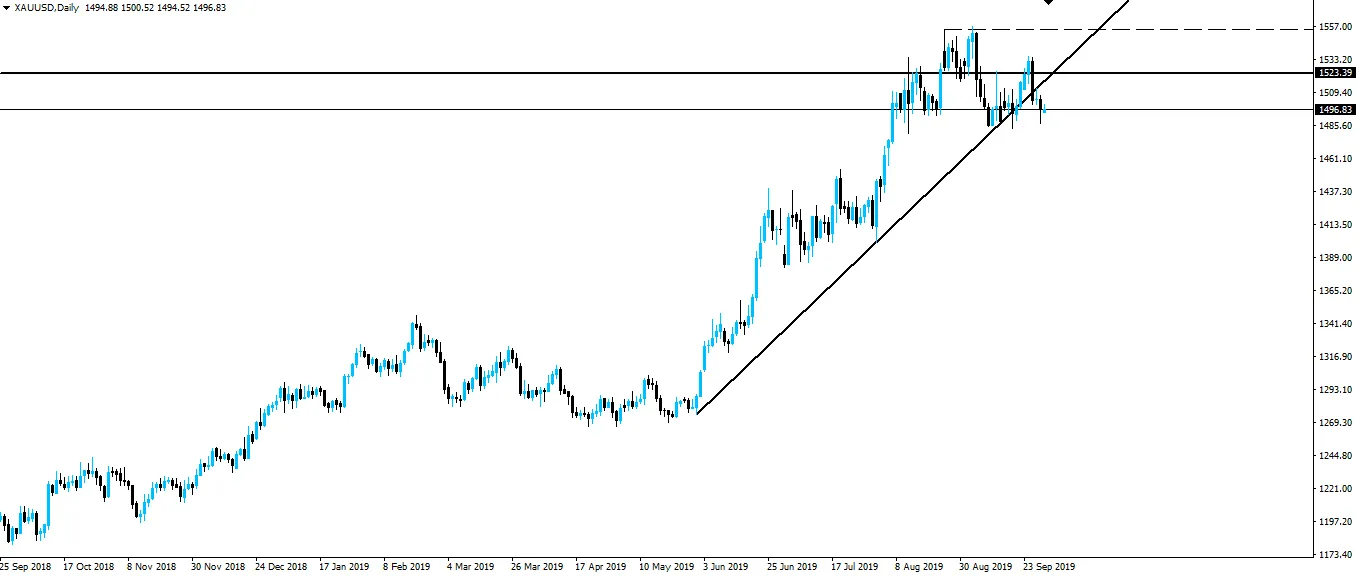

XAU/USD

- Higher time frame bullish trend.

- Below higher time frame (weekly) support/resistance.

Gold is in the mother of all bullish trends, but after gold rejected off weekly resistance, the pair is definitely in play for shorters.

This is another one that I'll be talking about inside my Inner Circle. I can already see an intraday retest of short term support turned resistance which I like to use as an entry.

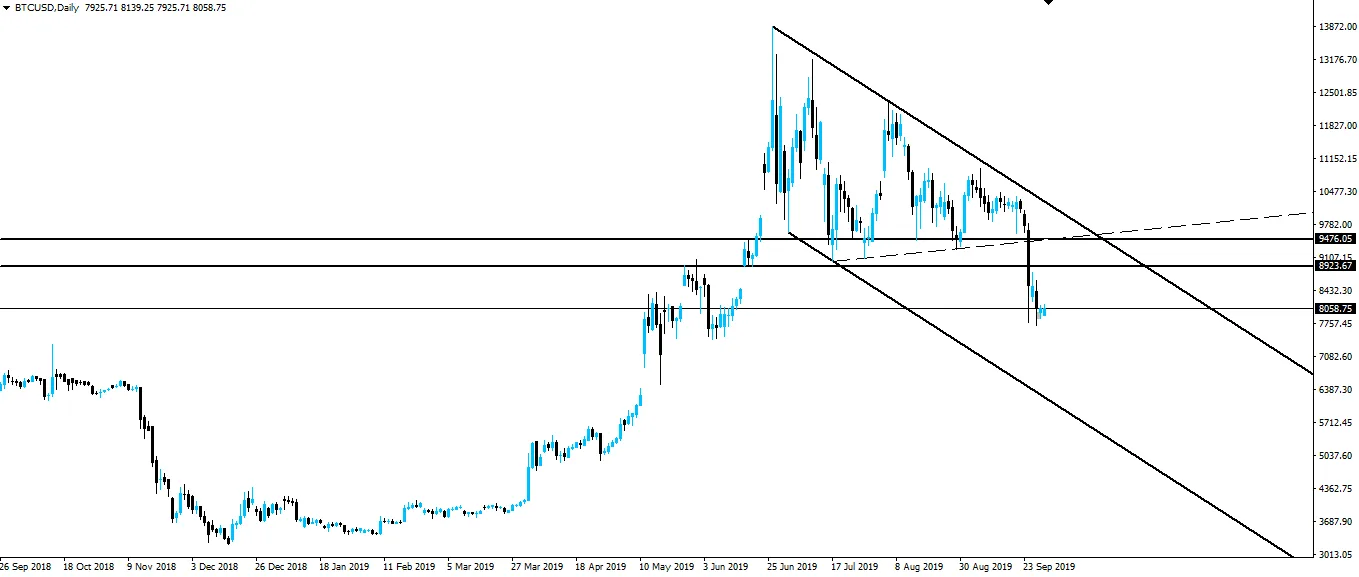

BTC/USD

- Higher time frame bearish trend.

- Below higher time frame support/resistance.

After last week's dramatic bitcoin higher time frame support break, the bears have regained full control of this market.

Look how much room price has to fall inside that channel. Who knows where price is going to find some horizontal support here.

Economic Releases

Monday: NZD ANZ Business Confidence CNY Manufacturing PMI CNY Caixin Manufacturing PMI GBP Current Account

Tuesday: NZD NZIER Business Confidence CNY Bank Holiday AUD Building Approvals m/m AUD Cash Rate AUD RBA Rate Statement AUD RBA Gov Lowe Speaks CAD GDP m/m USD ISM Manufacturing PMI

Wednesday: CNY Bank Holiday USD ADP Non-Farm Employment Change USD Crude Oil Inventories

Thursday: CNY Bank Holiday EUR German Bank Holiday USD ISM Non-Manufacturing PMI

Friday: CNY Bank Holiday AUD Retail Sales m/m CAD Trade Balance USD Average Hourly Earnings m/m USD Non-Farm Employment Change USD Unemployment Rate

Saturday: USD Fed Chair Powell Speaks

Return from Market Preview - In-Play Markets for the Week to forexbrokr's Web3 Blog