Direct from the desk of Dane Williams.

It's Friday morning and I'm flat out like a lizard drinking trying to manage my trades, complete my daily Hive admin tasks and finish some copywriting client work that was technically due yesterday.

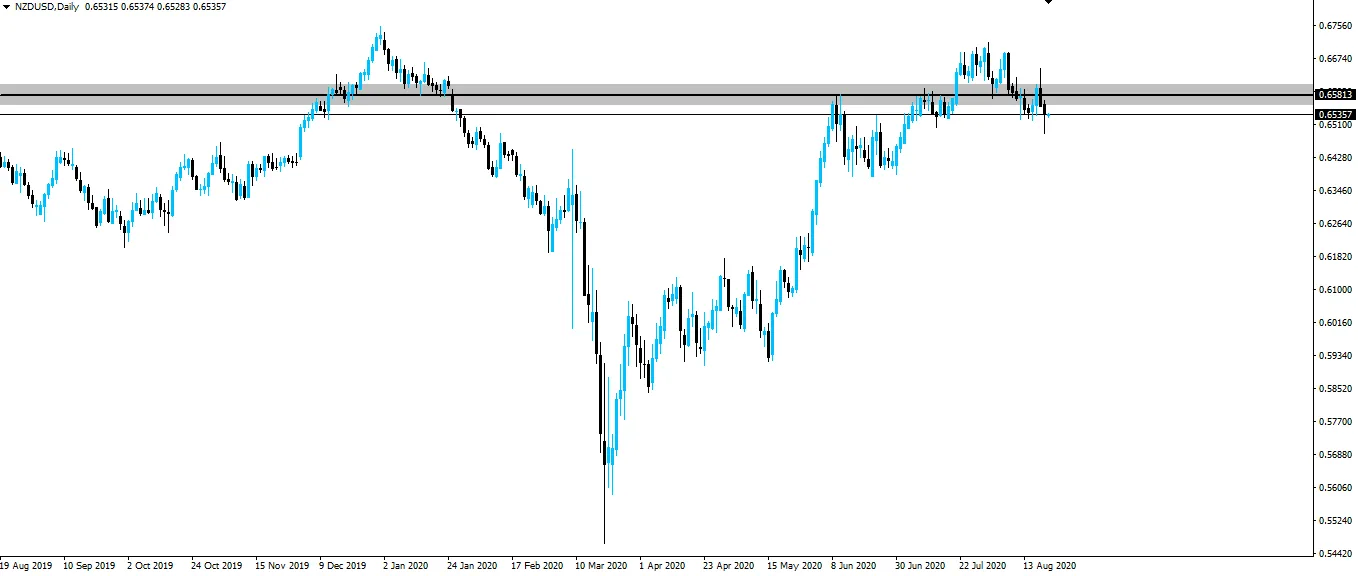

In terms of my trading, I wanted to talk about the Kiwi. We've had NZD/USD edging sideways along daily resistance for a while now and with the RBNZ's talking about negative interest rates, I'm expecting some sort of repricing to occur.

Check out the daily zone I'm talking about on the Kiwi daily chart below.

NZD/USD Daily:

That price action right there over the last two days, is why textbook fundamentals and day trading don't go together. So the RBNZ announced that they're now open to negative rates and you can see NZD/USD pings higher through resistance.

"Umm, that's not what it says on page 2,459 of Econ for Dummies..."

You can then see that probably after stopping out any economics geek that bought the news, price smashed back down through the zone. The wick shows the move had quite a bit of momentum behind it too.

Right there is the smart money, taking advantage of the dumb. Some refer to it as stop hunting, but it's just smart money absorbing liquidity where it is obviously being left.

The irony in this case is that the dumb money probaby belongs to the smartest guys (textbook smarts at least), in the room,

Best of probabilities to you,

Dane.

FOREX BROKR | Hive Blog Higher time frame market analysis.

Posted Using LeoFinance

Return from NZD/USD Reacts to RBNZ Chatter About Negative Rates to forexbrokr's Web3 Blog