Hey guys,

My football club Sydney FC, got dicked in Asia last night and I’m on struggle street, nursing a hangover today so please bear with me.

Something I always notice when Australian football clubs play in Asia, is just how different culturally we are from our Asian neighbours. There aren’t plenty of obvious differences, but there is one in particular that really gets me and that’s how cheating to get a result is viewed.

The final match day scenario was that Sydney played Shanghai Shenhua, while Kashima played Suwon. Shanghai were the only team mathematically eliminated from qualifying for the knockout phase. Sydney needed to win and have Suwon lose or draw in Kashima.

With nothing to play for, Shanghai started basically a team of reserves and youth players. In my mind, these players would be hungry to play football and show what they can do in hopes of earning a first team spot.

But instead we were put through 90 minutes of play acting, faux injuries and defensive tactics. It was cringeworthy to watch.

Fair enough if there was something to play for, but there was nothing but pride. A trait that means something totally different in Asia than it does in Australia.

Market Overview

After prattling on about football and culture above, I guess it’s time to actually talk some markets, right? Well there are four major market talking points today that we need to take a look at. These being:

-

The way that Shinzo Abe’s visit to the United States to meet with President Donald Trump is effecting the Yen.

-

The People’s Bank of China’s move to support liquidity and it’s effect on the Yuan.

-

The way that earnings season is effecting the US stock market at key resistance.

-

Why the crypto market is still holding up so well, led of course by the big daddy, Bitcoin.

So... Let’s dive into some charts shall we!

Forex Markets

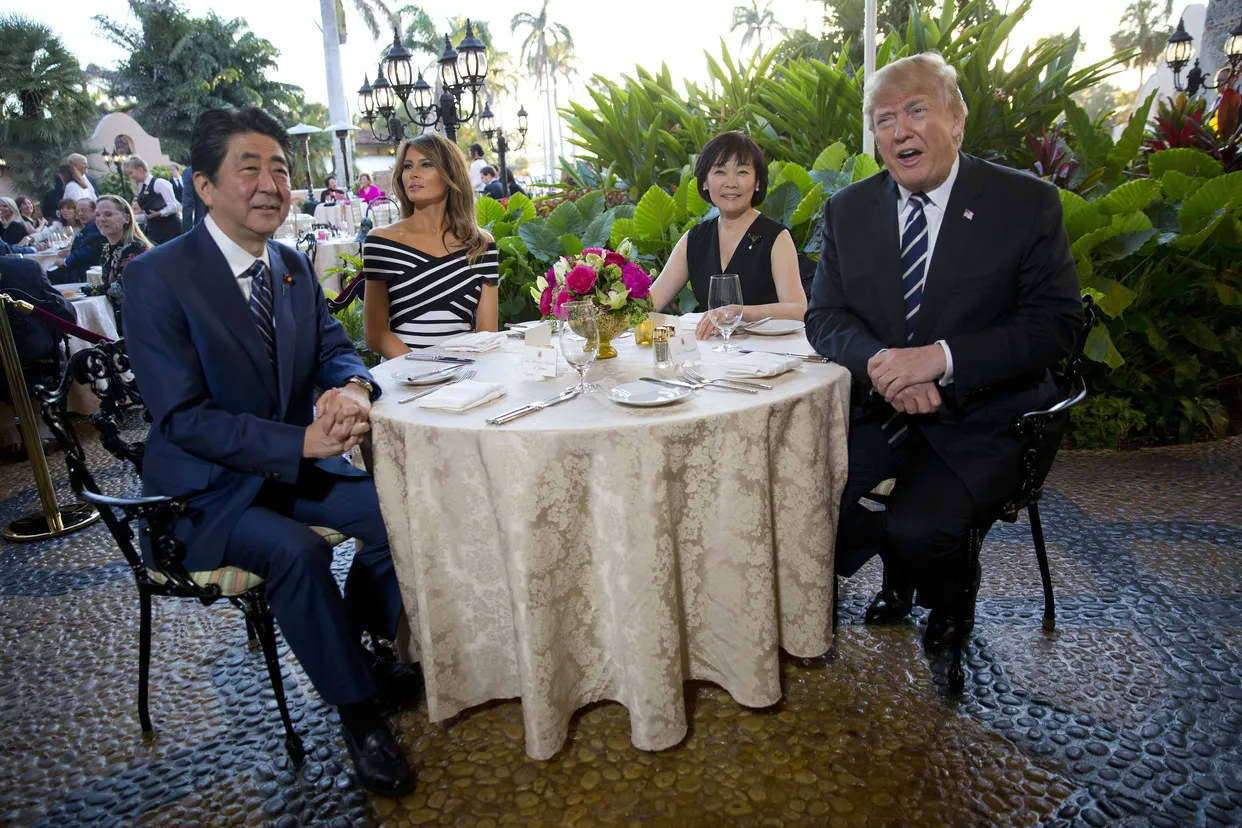

We start off with Shinzo Abe’s meeting with Donald Trump. It was the Japanese Yen that dropped on early signs that the Trump-Abe summit won’t actually see any new trade demands from the US. By removing this risk, money flowed out of the safe haven currency.

Trump has been trying to reassure Abe of the close alliance between the US and Japan. This is required as Trump will soon meet with North Korea and Abe seeks assurance that no deals will be struck that will put the Japanese in an awkward position.

The Trump administration has also signaled that will look at exempting the Japanese from the new tariffs on steel and aluminium that they obviously want to avoid and this has all combined to keep the Yen capped:

USD/JPY 4 Hourly

So USD/JPY bounces again off that short term level. The steps still look good and I’m looking for this sentiment to continue into the week.

Now I don’t really give a shit about the Chinese Yuan as it’s not a market I’d ever be caught dead trading, but The People’s Bank of China cutting the reserve-requirement ratio for some banks to reduce their funding costs is still a huge macro story we need to be abreast of.

The idea is that in turn, this will help ease conditions for businesses and individuals. Artificially and traditionally unsustainable, but this is China and there are no limits here. Even better, if they are in fact found, then the numbers are just fudged so it’s all good!

The 1% reduction means hundreds of billions of Yuan will be released.

Ah good times.

Indices Markets

Indices markets have today followed the Wall Street lead up, thanks to the release of strong earnings numbers pretty much across the board.

Companies like Netflix and Goldman Sachs were some of the names that announced bumper numbers for their first quarter earnings and overall S&P 500 earnings are expected to increase 18.6% in the quarter compared to one year ago. (Thanks Reuters.)

But when it comes to the technicals, I’m actually pretty pissed off that this level has gone:

SPX Hourly

Time to re-evaluate this one, I think.

Gah!

Cryptocurrency Markets

When it comes to crypto markets, I’m the last person to be trying to attribute a price drop or rip to a headline. It’s a technical market driven by levels and the way markets trend between them!

Just check out today’s price action on an intraday chart:

BTC/USD 15 Minute

What the fuck was that?! 😂

Enjoy guys ✌🏻.

@forexbrokr | Steemit Blog

Market Analyst and Forex Broker.

Twitter: @forexbrokr Instagram: @forexbrokr

Leave a comment to chat about forex and crypto trading mentorship.

Return from Trump and Abe Chat, Earnings Support Stocks and Some Cray Cray Bitcoin Price Action to forexbrokr's Web3 Blog