### USD/CAD Key Points

- Still within the higher time frame bullish channel we’ve been watching.

- Would rather trade in that direction (being a buy).

- The retest of previous resistance turned support has given us the perfect zone to trade around intraday.

USD/CAD Technical Analysis

So it’s been eight days since I posted. No, I haven’t disappeared, I’ve just been trading the same USD/CAD bouncing within ascending channel zone idea that I last wrote about. Trading doesn’t have to be hard work. Why make it any more complicated that it needs to be?

But with price pulling back and looking like tagging the zone again, it’s worth adding some thoughts here. Take a look at the two charts below:

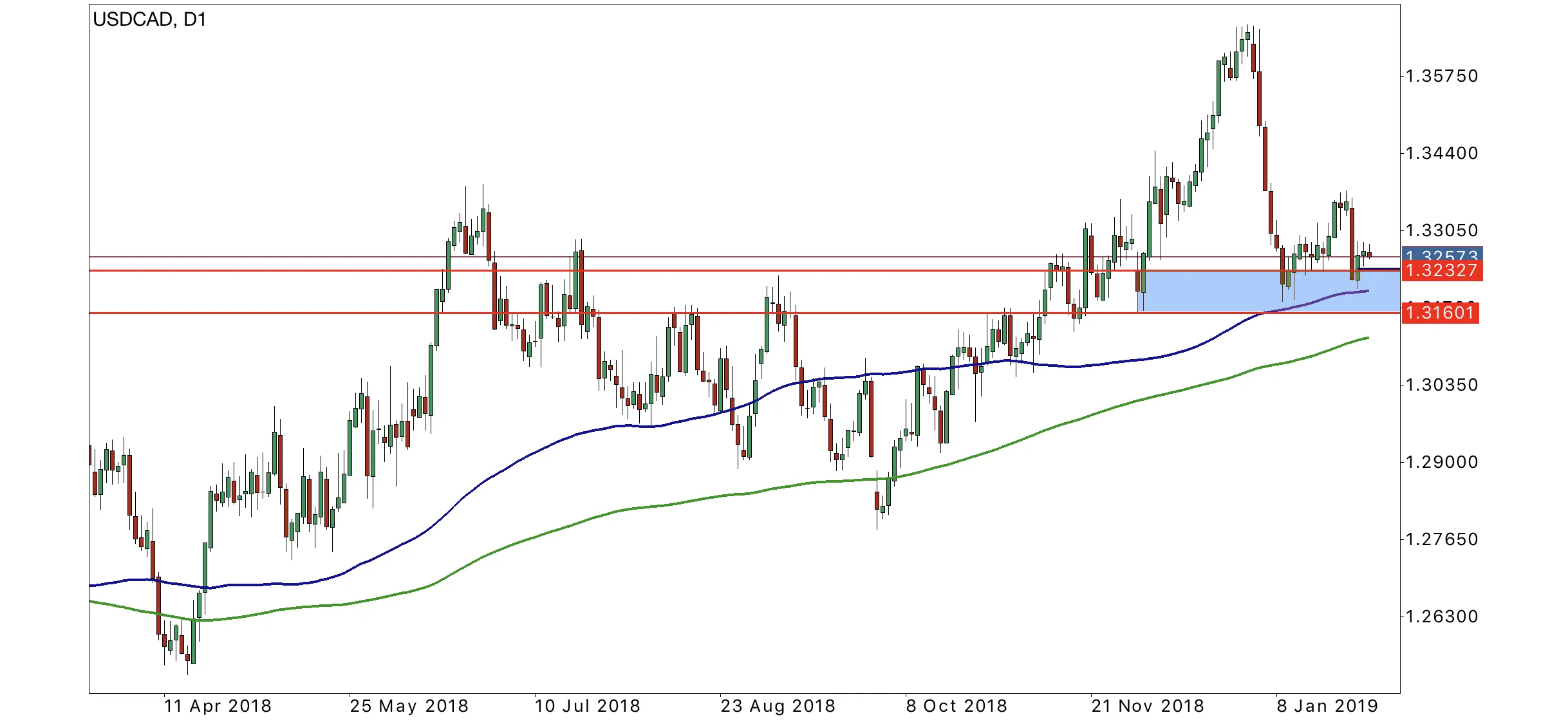

So first up we have the higher time frame, USD/CAD daily chart. It’s the same setup that we’ve already spoken about and we’re looking for price to tag the zone, bounce out of it again and then move down to the intraday.

The intraday, USD/CAD 15 minute chart is the second one that you can see I’ve shared and shows price having bounced out of our zone and then a clear intraday level of previous resistance that can be used as a level to buy. That is if price gets back down there and doesn’t just pitch straight through it of course.

Your stops would be below the higher time frame zone if you want to let it breathe, or below the swing low if you’re being aggressive. That my friends, is up to you and your trading style.

Keep trading the zone until it’s no longer there to trade.

Best of probabilities to you!

Economic Releases to Watch Today

-

AUD - CPI q/q

-

AUD - Trimmed Mean CPI q/q

-

USD - ADP Non-Farm Employment Change

Return from USD/CAD Buy Zone Still in Play to forexbrokr's Web3 Blog