Direct from the desk of Dane Williams.

Last week, we spoke about USD/CAD retesting daily support as resistance as the pair's fall temporarily paused at one of our hgher time frame zones.

Obviously the USD side of the pair has been a massive drag, but this zone gave us a chance to get a short on in a place where we expect price action to be clean and efficient.

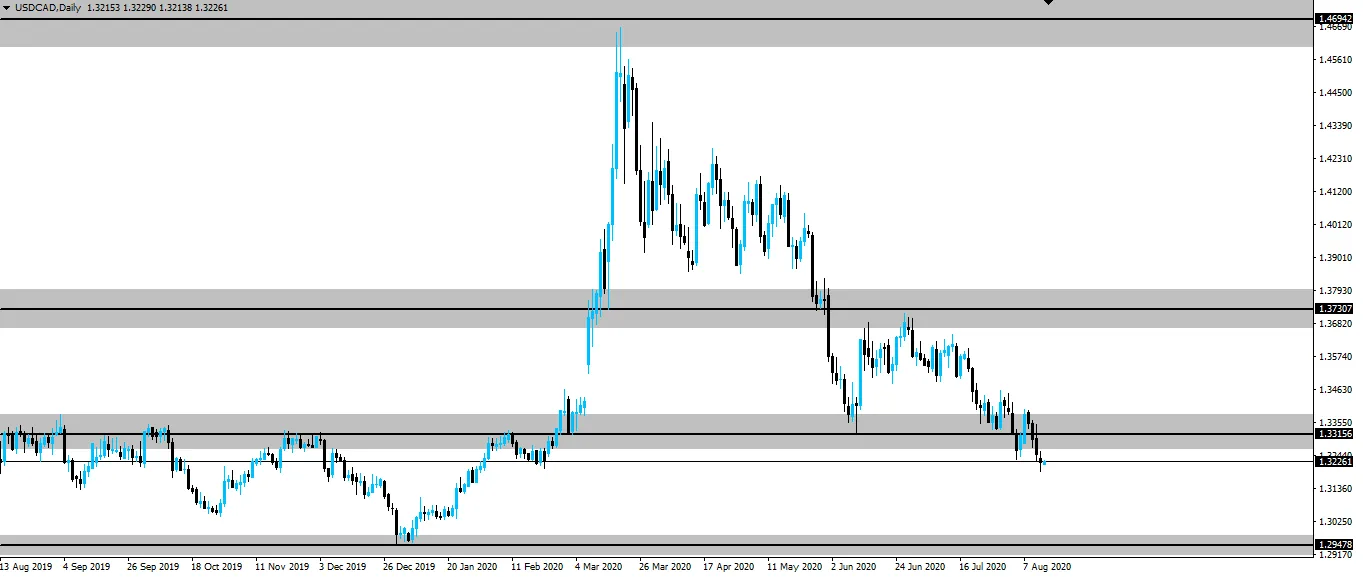

If the zone isn't already on your chart (click the link in paragraph one), then take a look at where we're at today on the loonie daily below.

USD/CAD Daily:

Pretty simple, yeah? I've just used the most recent swing low, but you can see its significance throughout 2019, rejecting multiple times from the zone as resistance too.

As you read on that previous USD/CAD blog, we were looking to short because price had already gone through the higher time frame zone and come back to retest it.

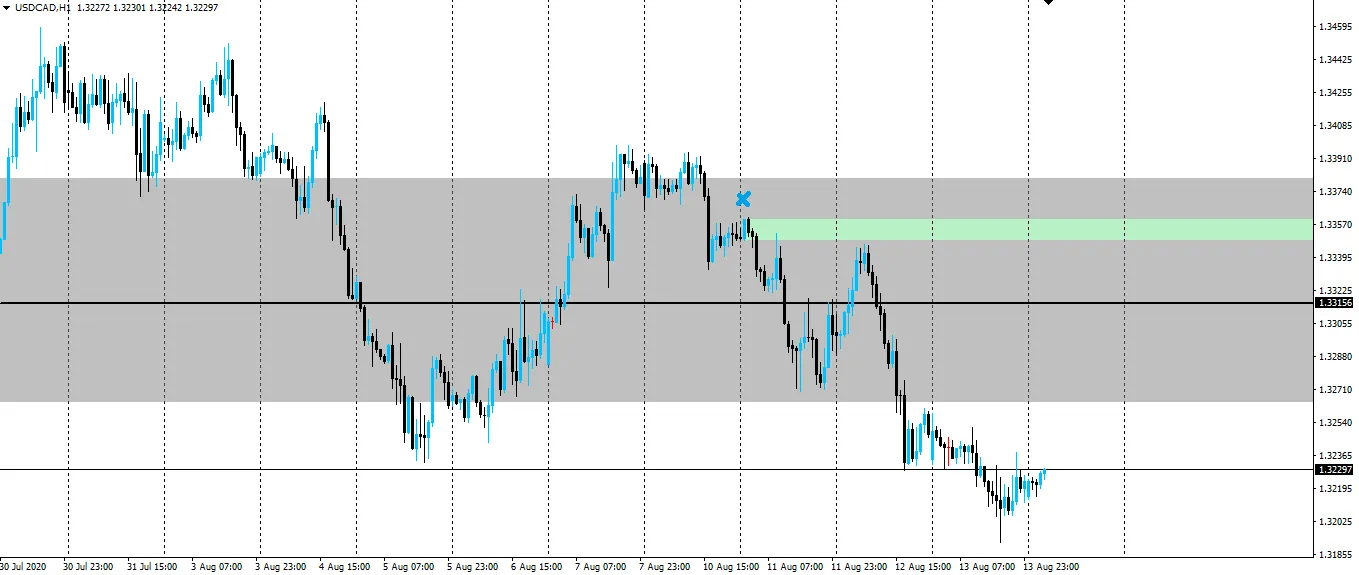

To do that, we zoom into an intraday chart such as the hourly below and look for previous short term areas of support turned resistance to sell into.

USD/CAD Hourly:

I marked the zone I did because it was after price had failed to make an intraday higher high, and then retested short term support as resistance.

This signalled to me that the short term bullish momentum had run out and it was time to short in the direction of the higher time frame move.

With price making a new low, let's see if this one can keep going now.

Best of probabilities to you,

Dane.

FOREX BROKR | Hive Blog Higher time frame market analysis.

Posted Using LeoFinance

Return from USD/CAD Continues Lower Following Clean Retest to forexbrokr's Web3 Blog