Direct from the desk of Dane Williams.

The Canadian economy relies on its massive oil export industry and as a result, the demand for CAD fluctuates with the demand for Oil.

A global pandemic mixed in with an oil supply overload is obviously not good for demand and the CAD has been smashed as a result.

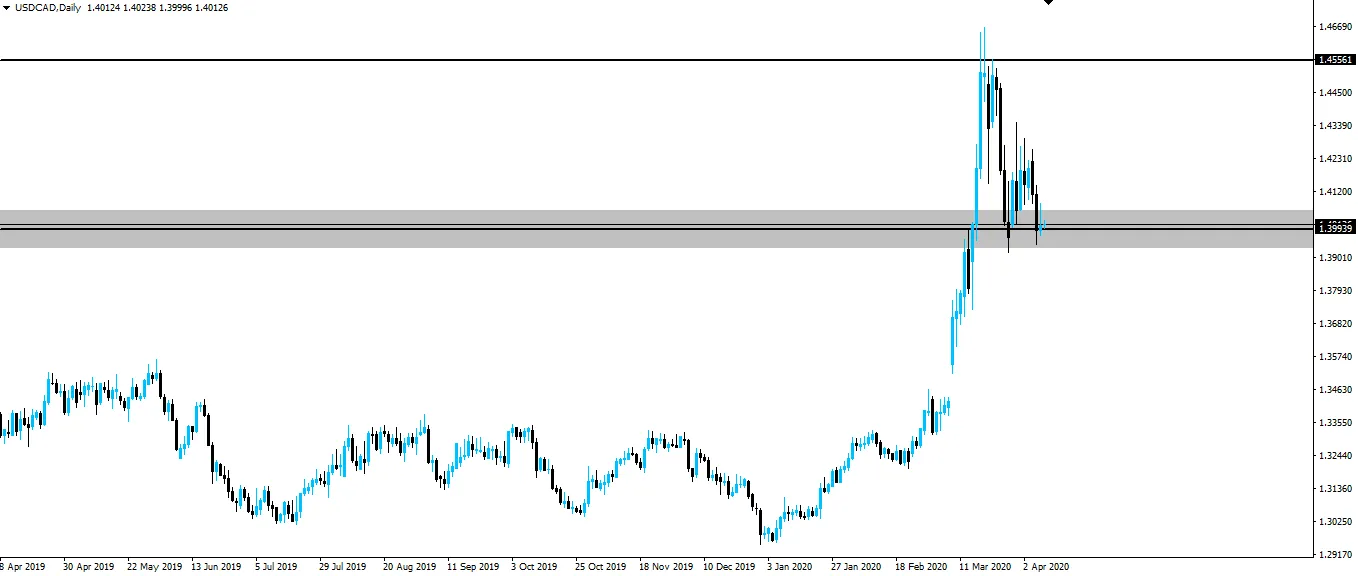

Take a look at the daily:

USD/CAD Daily:

That rip (so crash in the CAD), is crazy!

But you can see we've recently had somewhat of a relief rally in the Loonie, as the pair pulled back into previous daily resistance that's now acting as support.

USD/CAD now sits just above daily support, while WTI is capped by daily resistance.

Once again, this is no coincidence.

This inverse correlation remains super-important going forward and decisions in the oil markets, are going to still be the biggest factor around whether this USD/CAD zone acts as support or resistance.

All we can do is trade the price action we're given, so wait and see whether the higher time frame holds, then zoom into the intraday chart to refine your entries using the same process as always.

Best of probabilities to you,

Dane.

FOREX BROKR | Hive Blog Higher time frame market analysis.

Return from USD/CAD's Inverse Relationship with Oil to forexbrokr's Web3 Blog