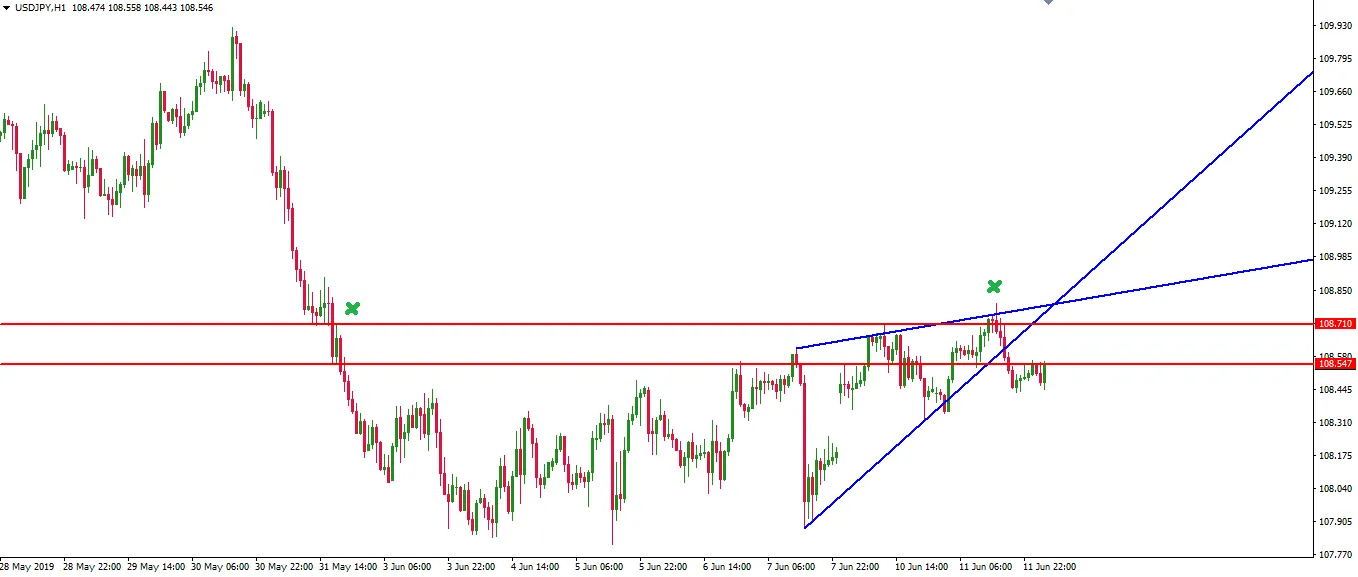

### USD/JPY Key Points

- Higher time frame, USD/JPY bearish trend.

- Price below horizontal support turned resistance.

- Intraday wedge break lower at confluence of resistance.

USD/JPY Technical Analysis

Morning team.

With yesterday's NZD/JPY intraday wedge breakout not pulling back and giving us the entry we were after, the market is being mighty nice and giving us a second chance at the same setup, but on USD/JPY.

Make a comparison with the Kiwi/Yen chart within yesterday's analysis, then take a look at the USD/JPY hourly chart below:

What we're looking at here is a beautiful confluence of resistance that looks ripe for shorting.

You can see the horizontal zone where price is retesting previous support as resistance. The fact that price poked its head through it to clear stops and then neatly has tucked back underneath it shows that we're definitely on the smart money side of the trade.

Price has now printed an ascending wedge which has also now broken to the downside. With price pulling back, this is your chance to take a step down another time frame or two and find areas of previous short term support that turn to resistance and to then manage your risk around those levels.

It's always the same setups. Simple and ripe for the taking. We missed yesterday's trade being conservative, but we've got the right price action for an entry here. Don't let this one slide by.

Best of probabilities to you.

Dane.

Upcoming Economic Releases

USD CPI m/m USD Core CPI m/m

Return from USD/JPY Confluence of Resistance is Ripe for a Short to forexbrokr's Web3 Blog