USD/JPY Technical Analysis

Afternoon team,

Lets really hit the ground running this week and get straight into the charts with a look at one such in play currency pair - USD/JPY.

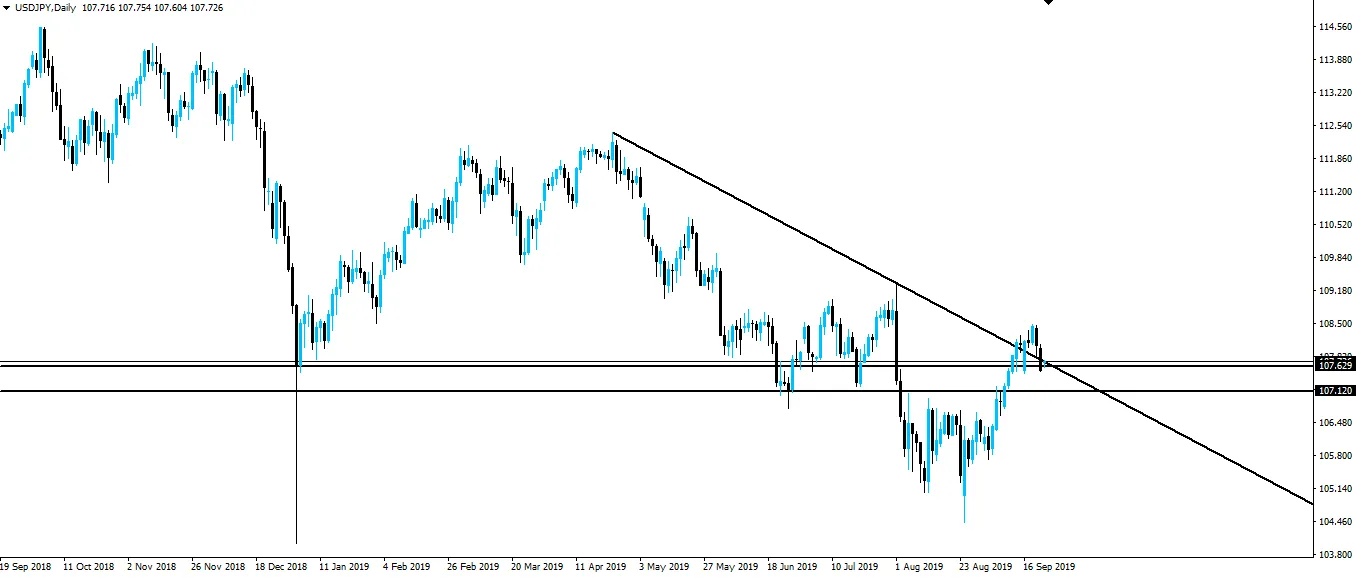

As identified in yesterday's weekend market preview, we have USD/JPY now above higher time frame support/resistance.

Just take a look at the daily chart below.

You can see that price is above the horizontal support/resistance zone, as well as being now outside of the daily trend line that had been capping price for the entire year.

But after breaking out above this confluence of resistance, price has now pulled back to retest previous resistance this time as possible support.

With price now sitting right on the zone, USD/JPY moves to being one of my in play pairs and that means we're looking to trade it.

Now zoom in and take a look at price action around the zone on the hourly.

On the intraday chart above, you can see that while price has broken out to the upside, there has really been no momentum whatsoever.

Price has already retested the previously broken resistance zone as support 3 times.

But in saying that, price has opened the new trading week with a gap up which has put the pair back on the march higher.

USD/JPY - IN PLAY!

With my focus being on helping new traders get their start and equipping them with the tools to analyse the market in a simple, actionable manner, I now take my analysis inside my Inner Circle ⭕️.

It's inside my email and group where I really analyse how to go about trading these markets that I've identified as in play on the blog. I'll see you there!

Best of probabilities to you,

Dane.

Today's Economic Releases

Monday: CNY Manufacturing PMI NZD ANZ Business Confidence CNY Caixin Manufacturing PMI GBP Current Account

Return from USD/JPY Retesting Confluence of Previous Resistance as Support to forexbrokr's Web3 Blog