Hey guys,

Why is getting haircuts such a shit experience? I fucking can’t stand it!

I have thick hair that just grows up and outward. It gets pretty out of hand, pretty quickly, which just means haircuts.

Small talk with middle aged white ladies or sleazy Arab dudes. Disgusting.

We’ll get into the Bitcoin face rip a bit deeper in today’s blog, but hilariously the lady hairdresser I had today, asked me about bitcoin!

I was mega vague and when the shitty smalltalk turned to work, I just gave her the equally as vague answer of working in finance and she went straight down the crypto path.

She had no idea what price was doing and I got the impression that if I hadn’t have started talking about it, she wasn’t a fan.

I love a good, real world contrarian indicator and it doesn’t get any better than your middle aged, white lady hairdresser with negative views.

BUY THE FUCKING DIP!

Market Overview

The whole risk tone around markets has seemingly dissipated to end the week. Trump hasn’t chilled out

So with risk flows and market correlations in play, this all should mean that the US Dollar slips, indices begin to rise and bonds fall. Right?

Well I’ll share some charts below and that’s pretty much what we’ve seen, but the exciting asset class has of course been our lovely friend, crypto!

I asked what you thought of the relationship between stocks and crypto earlier in the week and surprising to me at least, consensus seems to have switched to Bitcoin being a risk asset, rather than a digital gold safe haven.

And as you’ll see on the charts, the overall market tone switches to risk-on and Bitcoin rips faces.

Confirmation?

Forex Markets

So we’ve talked about the fact that markets seem to have taken a chill pill and forgotten about the fucked up world we live in, but the risk currencies haven’t really done anything too exciting.

I really like these higher time frame resistance levels on the Pound and Euro and they’ll go a long way to help explain why.

Have a look at the charts:

GBP/USD Weekly

EUR/USD Weekly

Yeahh, look at those bad boys!

I’ve had a quick look on the lower time frames and nothing jumps out at me in terms of intraday levels to trade off but remember it’s Friday night and we’re definitely going to get something coming up in the coming weeks from these.

Not to mention the USD/JPY long trade we’re in still ticking up and keeping the position building nicely.

Go through the links on the blog or the @forexbrokr Twitter where I try to thread charts as trading opportunities unfold, but here’s the latest UJ hourly:

USD/JPY Hourly

As I’ve been saying, so long as no new lows are made, there’s no need to deviate from building the long position as were above higher time frame support and the momentum continues.

Cryptocurrency Markets

But yeah, the story of the day is all crypto. And funnily enough, nobody seems to really have a reason for the rip.

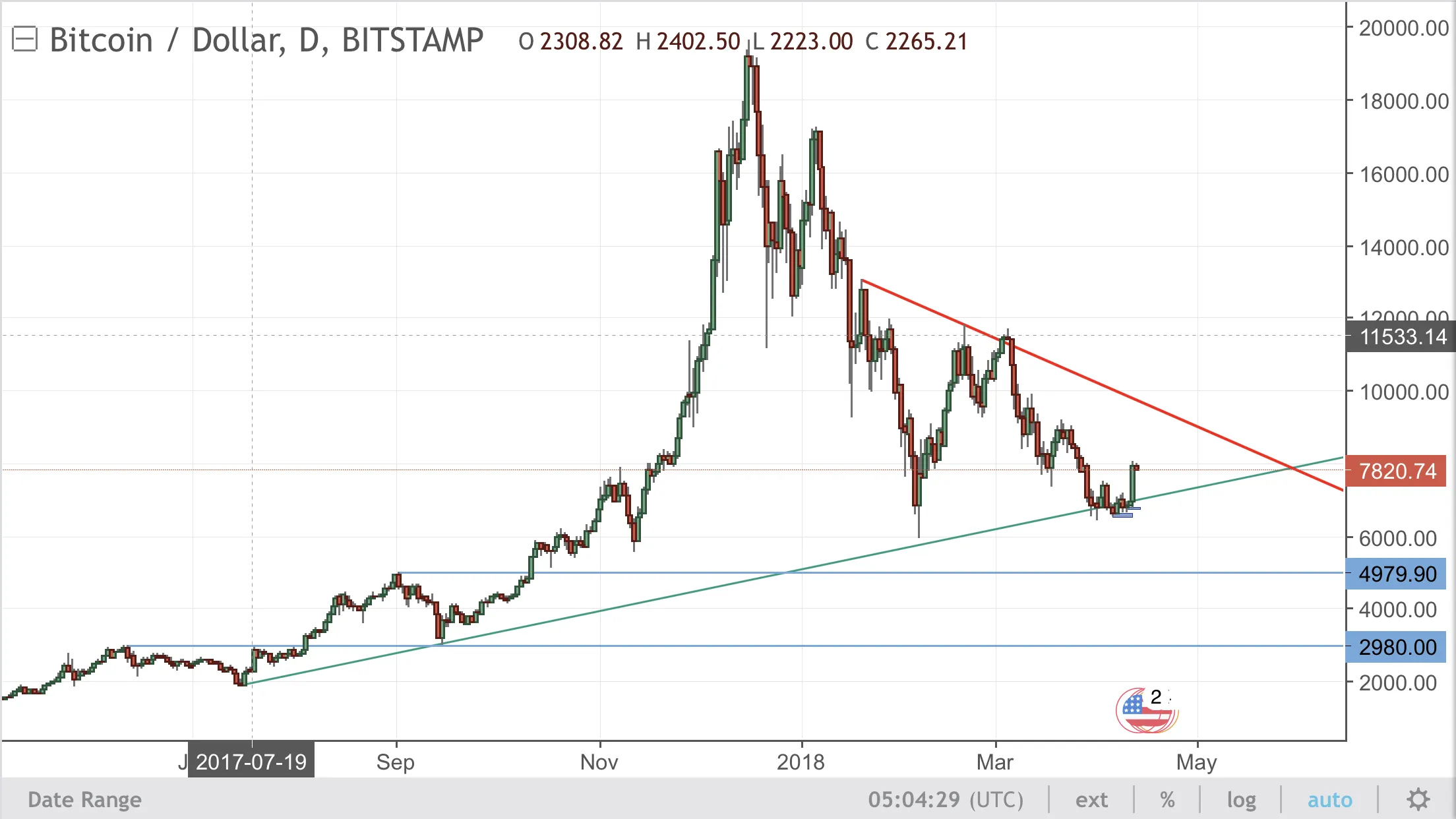

I’m very much a subscriber to the techncials lead fundamentals newsletter and with Bitcoin sitting at higher time frame support, this sort of move was just waiting to happen:

BTC/USD Daily

But please tell me that some of you traded the intraday pullback levels that we identified.

Look at that second pullback and bathe in it:

BTC/USD Hourly

When things go your way, things go your way. Enjoy.

I’ve also been talking about STEEM and EOS longs which pretty much did the same thing from their intraday levels that I’ve shared on the blog, but I’ll leave them for tomorrow. I just think there’s a lot more in this.

Do you think this sort of rip has a different feel to the simple restesting of previous support as resistance in a downtrend as it continues?

I’m feeling it. Let’s see what happens.

✌🏻.

@forexbrokr | Steemit Blog

Market Analyst and Forex Broker.

Twitter: @forexbrokr Instagram: @forexbrokr

Leave a comment to chat about forex and crypto trading mentorship.

Return from Was this Crypto Market Rip the Answer to our Market Correlation Question? to forexbrokr's Web3 Blog